Practice Management

Accounting reports: definition, types, and best practices for CPAs and accountants

As a CPA or accountant, your role extends far beyond balancing ledgers. You're a trusted advisor and strategic partner, helping clients navigate their finances with confidence. A key tool in this partnership is the accounting report. This document serves as the foundation for nearly every critical business decision, from managing cash flow to planning for long-term growth.

In this guide, you'll learn about the most important types of accounting reports and how to leverage them to help your clients manage finances, meet compliance requirements, and make informed decisions.

What are accounting reports?

Accounting reports summarize a business's financial activities and position over a specified period. These reports are derived directly from accounting records and present financial information in a standardized format, making them easier to interpret and analyze. They're a crucial component of financial reporting in accounting, used to inform both external stakeholders and internal management.

The three main types of accounting reports

While there are countless types of accounting reports, they can generally be categorized into three main groups based on their purpose and audience: financial, management, and tax reports. Understanding the distinctions between these categories is essential for both CPAs and their clients.

Financial accounting reports (external)

Financial accounting reports are primarily designed for external use. They provide a standardized view of a company’s financial health to stakeholders outside of the business, such as investors, lenders, and regulatory bodies. They’re crucial for clear communication and making informed decisions.

Here are the most common financial accounting reports:

- Income statement (profit and loss statement): This report summarizes a company's revenues, expenses, and the resulting profit or loss over a specific period, such as a month, quarter, or year. It's used to assess a business's profitability and overall operating performance.

- Balance sheet: Providing a snapshot of a company's financial position at a specific point in time, this report details its assets, liabilities, and equity. It's used to evaluate financial position, liquidity, and capital structure.

- Cash flow statement: This report tracks incoming and outgoing cash over a defined period. It's divided into three key sections: operating, investing, and financing activities. It’s essential for monitoring a business's liquidity and ensuring it can meet its financial obligations.

- General ledger report: This is a comprehensive record of all financial transactions. It acts as the underlying source for all other financial statements.

These reports provide a foundation for transparent communication with external stakeholders.

Management accounting reports (internal)

Management accounting reports are internal and operational in nature. They're designed for executives, managers, and finance teams. Unlike financial statements, they're not standardized by rules like GAAP but are customized to a business's specific needs. These reports are vital for day-to-day decision-making and cash flow management.

Here are a few examples of internal management reports:

- Budget vs. actual report: This report highlights variances between a company's planned figures and its actual financial performance.

- Accounts receivable aging report: This report shows outstanding invoices and how long they've been unpaid. This information is essential for managing receivables and facilitating collections. For more help managing this, you can download our accounts receivable template.

- Accounts payable aging report: This report lists all unpaid bills and categorizes them by their due date. It’s useful for managing cash outflow and payment obligations. To help with your payments, download our accounts payable template.

- Key performance indicator (KPI) dashboard: This report tracks metrics like gross margin, AR/AP days, or operating ratios, providing a quick, visual overview of a company's health. To learn more about tracking KPIs, read our article on accounting KPI metrics.

- Forecasting and projections: These reports predict future revenues, expenses, and cash flows, making them crucial for strategic planning. Download our cash flow forecast template to get started.

Tax accounting reports (internal and external)

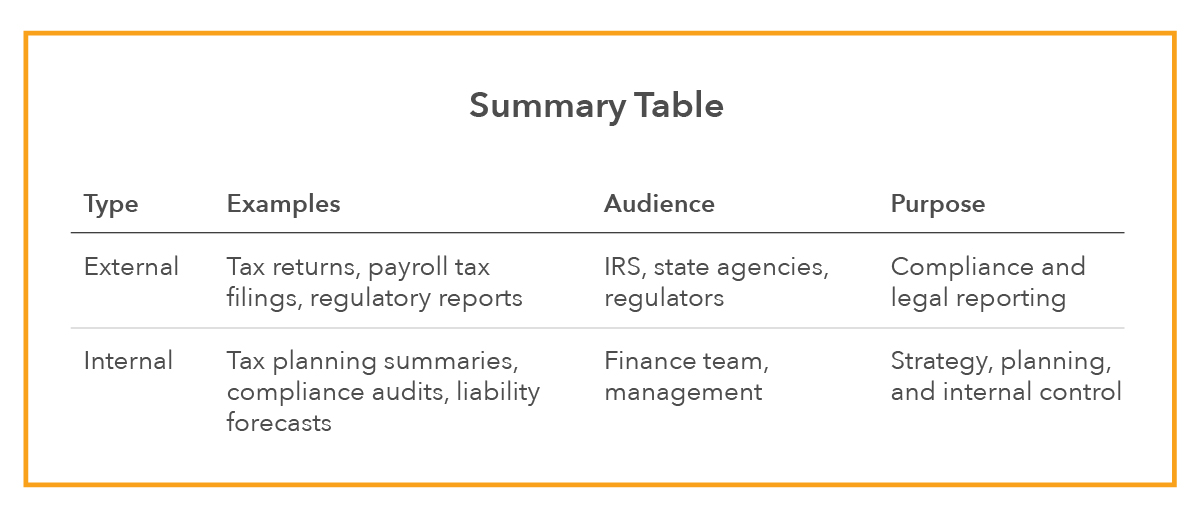

Tax accounting reports are a unique category as they can be both internal and external, depending on their purpose. These reports help clients meet compliance requirements while also providing data for strategic tax planning.

- External tax reports: These are formal reports filed with government agencies or regulatory bodies for legal compliance and reporting. Their audience includes external parties like the IRS and state tax authorities. They must adhere to strict rules and formats and are subject to audits and penalties if they're incorrect or late.

- Examples: Payroll tax reports, such as Form 941 and W-2s (learn more with our blog on payroll tax and Form 941), sales and use tax reports, and corporate income tax returns.

- Internal tax reports: These are internal analyses and summaries prepared for management to help ensure proper compliance and planning. Their audience is executives, finance teams, and internal auditors. They support strategy, planning, and monitoring compliance status.

- Examples: Tax liability forecasts for upcoming quarters, compliance checklists for filings or audits, and internal audit reports on regulatory readiness.

Best practices for accounting firms

Beyond generating reports, accounting firms strive to provide the most value to clients. Following these best practices can help firms save time, ensure accuracy, and improve communication:

- Leverage technology: Use modern accounting and reporting software to automate repetitive tasks, reduce human error, and generate reports instantly.

- Regular reviews: Establish a monthly or quarterly cadence to review reports with clients. This helps you catch errors early and provides a consistent touchpoint for advisory discussions.

- Client education: Don't just deliver the report; provide guides or dedicated sessions to help clients understand what they're seeing and what the numbers mean for their business.

- Documentation: Maintain clear, audit-ready records for every report generated. This ensures you can always back up the data and maintain compliance.

Ultimately, these best practices are key to becoming a successful accounting firm that builds trust with its clients.

Optimizing reporting for accounting firm growth

Optimizing your firm's accounting and reporting process is essential for scaling your business and fostering long-term client relationships. Here are a few ways to get started:

- Create scalable templates: Develop standardized, scalable templates to manage more clients efficiently without reinventing the wheel each time. Many modern solutions offer pre-built options, like the CPACharge reporting templates, to help you get started quickly.

- Use dashboards: Leverage dashboards for real-time insights during client meetings. They quickly highlight key metrics and serve as powerful tools for advisory conversations.

- Upsell advisory services: Use reports to spot trends or red flags, then leverage that information to upsell high-value advisory services.

To fully optimize your reporting workflow, you should consider how technology can support your firm. A robust and user-friendly payment solution can simplify these key business functions and drive growth for your accounting firm faster than manual operations alone.

Simplify reporting and payments with 8am™ CPACharge

Mastering accounting reports is a critical component of a successful accounting firm, but managing the payments and billing process is just as important. 8am CPACharge is a payments and invoicing solution designed specifically for accounting professionals, helping you streamline your entire workflow. With CPACharge, you can easily generate key business reports and boost productivity and profits.

CPACharge’s features help simplify your reporting and payment process by providing:

- CPACharge reporting: Access to key business metrics and reports.

- CPACharge dashboard: A real-time overview of your firm’s financial health.

- Online payment options: A variety of payment methods to get paid faster.

- Easy billing and clear invoicing: Simplify your billing with professional invoices.

Ready to simplify your firm’s reporting and billing process? Book a demo or sign up for CPACharge to get started today.

Accounting Reports FAQs

What are the three main types of accounting reports, and how do they differ?

The three types of accounts in reporting are financial, management, and tax reports.

- Financial accounting reports (e.g., balance sheet, income statement, cash flow statement) are standardized reports for external use.

- Management accounting reports (e.g., budget vs. actuals, KPI dashboards) are customized for internal, day-to-day decision-making.

- Tax accounting reports (e.g., tax schedules, estimated payment reports) are used for both internal planning and external compliance with government regulations.

How often should accounting reports be generated and distributed?

The frequency of reporting depends on the type of accounting report. Financial statements are typically prepared on a monthly basis. Budget updates, forecasts, and reconciliations are often generated quarterly, while year-end packs and audit documentation are prepared annually. Following the right cadence ensures compliance and effective advisory workflows.

Which accounting report is most useful for improving cash flow visibility?

The cash flow statement is the most useful accounting report for improving cash flow visibility. It specifically tracks the inflows and outflows of cash from operating, investing, and financing activities, providing a clear picture of a firm’s liquidity. It's a top concern for many clients and is essential for strategic planning.