Payment Woes That Held the Firm Back

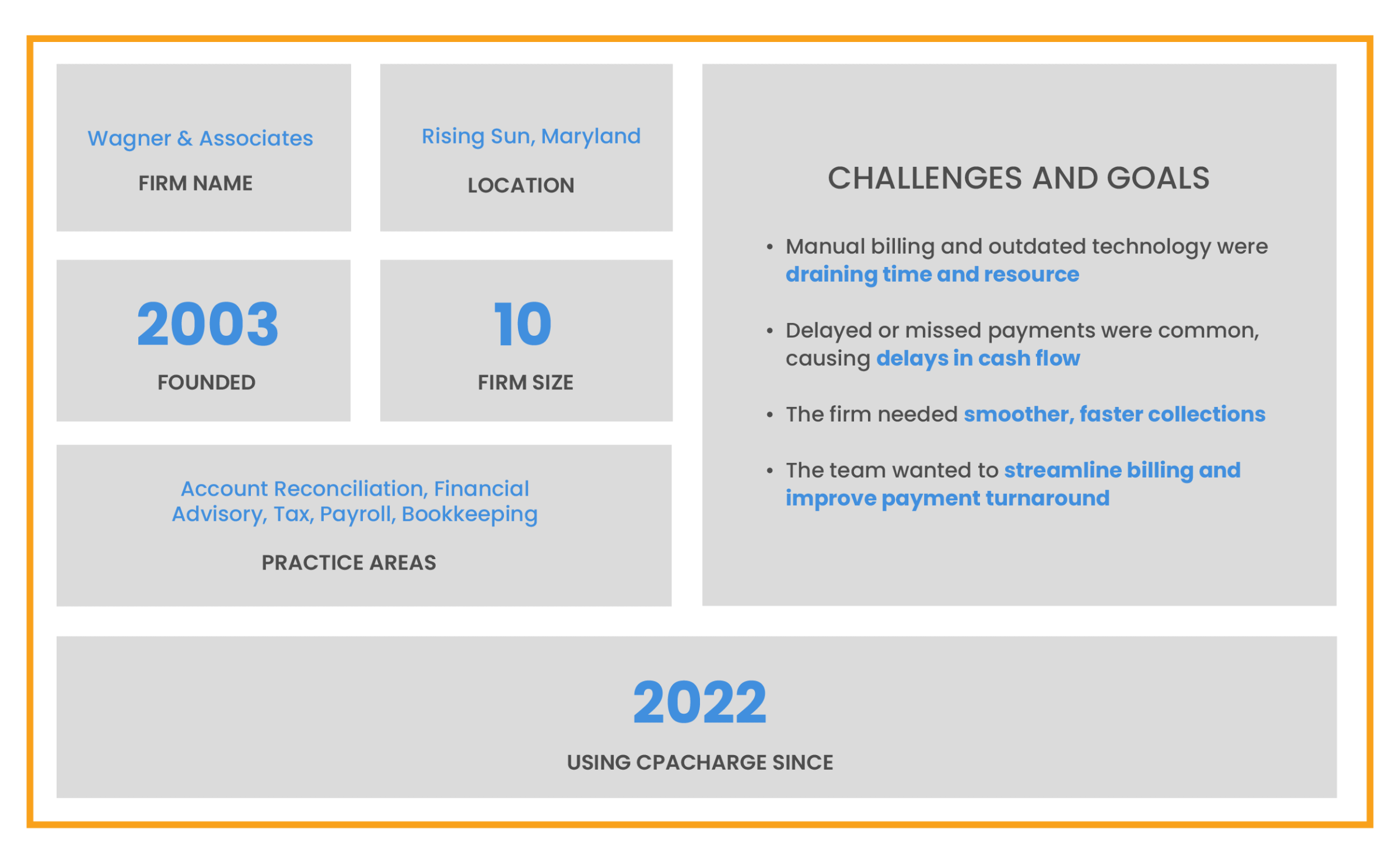

Before switching to CPACharge, Wagner & Associates used a legacy system that created more challenges than solutions. Recurring billing required tedious manual entry each month, draining valuable staff time and increasing the likelihood of human error.

Mistyped amounts, outdated account information, and unnoticed failed transactions often led to awkward follow-up conversations with clients and unnecessary stress for the team. During peak seasons, the billing bottleneck slowed operations and left the firm chasing payments instead of focusing on client work.

The system’s dated interface lacked the flexibility and automation needed for a growing, modern accounting firm. It made a simple task—getting paid—far too complicated. As Patricia Wagner, CPA, founder, owner, and general partner of Wagner & Associates, described it: “It just wasn’t built with ease or efficiency in mind.”

A Seamless Payment Experience

Everything changed when Wagner heard about CPACharge at a RootWorks conference. After onboarding in 2022, the firm quickly experienced a dramatic shift in how they handled payments and how much time they saved.

Results at a Glance

85–95% of revenue now flows through CPACharge

Receivables dropped by over 50% during tax season

2–3 hours saved each month through automation

Faster client payments with fewer follow-ups

Freed-up time supported firm growth and resulted in expanding to a second office

With CPACharge, recurring payments are fully automated. Instead of keying in individual amounts each month, contracts are set once and simply renewed each year. “We don’t have to do anything—it happens automatically,” Wagner says. That alone recaptured hours of productivity each month.

But the transformation didn’t stop there. The firm integrated CPACharge with SafeSend, enabling clients to pay before accessing their returns—all within a single, secure link—no printing, mailing, or manual tracking required.

Quick Bill became a favorite tool for collecting payments quickly when clients overlooked their invoices. With just a few clicks, the team could send a secure, branded payment link directly to the client’s inbox. Clients appreciated the simplicity and convenience, while the firm saw payments come in faster and with fewer follow-ups. It turned what used to be a time-consuming chase into a streamlined, one-step process that kept cash flow moving and reduced administrative overhead.

As Wagner put it, “Before, it would take forever to get paid. Now with Quick Bill, payments come in fast.”

Today, 85–95% of Wagner & Associates' revenue flows through CPACharge, with eCheck and credit card payments almost entirely replacing the need for check handling. Now the firm enjoys faster collections, less overhead, and a smoother experience for clients and staff.

Key Results of Switching to CPACharge

Time Savings for the Firm

Wagner & Associates experienced an immediate boost in operational efficiency after switching to CPACharge. The team no longer spends hours each month manually entering payment information. “With [our old solution], it took me two to two and a half hours a month. With CPACharge, I only set it up once a year,” said Patricia Wagner. The automation was a clear turning point. “We don’t have to do anything—it happens automatically. Saving us two to three hours of time was wonderful.”

The contrast with their former billing system couldn’t be clearer. Wagner commented, “It was very complicated... CPACharge just works.” Today, CPACharge has become an integral part of their accounting practice management tech stack. As Wagner said, “It’s one part of my practice I don’t have to overly worry about.”

Faster Payments, Stronger Cash Flow

CPACharge had a significant impact on the firm’s financial operations. During tax season, receivables that used to hover in the six-figure range have dropped significantly. “Even during tax season, our receivables dropped from $130,000–$140,000 to maybe $50,000–$60,000,” Patricia shared. Clients pay more promptly, and the firm sees the results almost instantly. “Of the 70-some thousand that got invoiced, 55,000 of it is already in my bank.”

The majority of payments are now digital and seamless, and the shift away from paper checks has been dramatic. Wagner noted, “We don’t deal with checks anymore. We used to have to take them to the bank weekly—now it’s maybe once every other week.”

A Better Client Experience

Clients of Wagner & Associates have embraced the ease of CPACharge just as much as the firm has. The Quick Bill feature provides a frictionless client experience by letting them pay securely and on their own time.

The days of swiping cards or processing checks are nearly gone. “Clients don’t even need a swipe machine now. They just tap their card or use SafeSend—it’s easy.” Nearly all payments are now handled electronically. “We’ve only got one or two people who still pay by check. Everyone else is using CPACharge.”

Fueled Firm Growth

Adopting CPACharge wasn’t just about streamlining billing—it gave Wagner and her team the breathing room to grow the firm. “CPACharge has helped significantly. It freed up my time so I could grow the business,” she shared. That time savings contributed to the firm’s ability to expand and open a second office.

Always focused on using best-in-class tools, Wagner & Associates continues to lead with a tech-forward approach. “We try to stay on the cutting edge of tech. CPACharge is the best for getting your collections in—everyone says it.” The results are undeniable. “Receivables were better this year than they’ve ever been—and we had a brand-new person handling payments.”

Smoother Payments and Peace of Mind—On Autopilot

For Wagner & Associates, CPACharge delivered the one thing every busy firm needs: a reliable, automated solution that just works. “It’s simple, easy to use, and gives me peace of mind,” Wagner says. With faster payments, fewer headaches, and more time to focus on growth, CPACharge has become a trusted part of their daily operations.

Ready to see how CPACharge can work for your firm? Schedule a demo and experience the difference firsthand, or if you’re ready to get started, sign up now.

About the author

Mary Elizabeth Hammond is a Senior Content Strategist and Blog Specialist for 8am, a leading professional business solution. She covers emerging legal technology, financial wellness for law firms, the latest industry trends, and more.