The CPAs you support may have the know-how to get the cash flowing for your firm, but they might not always have the time to research ways to maximize earning potential. That’s where office managers like you come in. You foster your firm’s success each day by streamlining operations and enhancing client service. Cash flow is one more area you’re well-positioned to optimize. Here are five effective strategies you can employ to boost your firm’s cash flow.

1. Implement cash flow budgeting

Whether you create your firm’s budget or can influence the firms’ partners in the budgeting process, this is a great place to start to make sure you’re set up for optimal cash flow planning. It can be tough to boost cash flow without having a reasonable idea of how much revenue your firm could make over the course of the year. One effective way to keep up with this is by creating a cash flow budget. This budgeting strategy can help you predict whether your firm will generate more revenue than it spends.

Examine your firm’s profits from the previous year to create a sales forecast, predicting where profits may rise and fall throughout the year. Use this data to predict profits and expenses and come up with a projected bottom line. Note that this practice often works best in short windows (think one to six months), as it can be difficult estimating cash flow over a longer period of time.

2. Facilitate online payments

Thanks to Amazon, eBay, Uber, and a myriad of other internet-based businesses, more and more people today are paying for goods and services online. In fact, a recent survey showed that 65 percent of people expect to be able to pay their bills from a service provider’s website. If your firm isn’t already set up to accept online credit, debit, and ACH payments, now is the time to remedy that. You’ll not only better meet client expectations, but also enable them to pay their bill immediately upon receipt, which means improved cash flow for your firm.

Research and compare payment providers to find the best fit for your firm, and then schedule time to recommend options to the firm partners or other key decision makers. If you meet resistance, remind partners that research has found professional services firms get paid as much as 39 percent faster when accepting online credit card payments.

Choosing and setting up a payment solution is step one. For step two, it’s crucial to let clients know that they can pay quickly and easily by credit, debit, or ACH right in your office at their appointment, or online when they receive their bill. Display signage at the front desk letting clients know all of their convenient payment options, and work with your team to add a prominent “Pay Bill” button to the firm’s website. For those clients who pay by check, you can even offer a friendly verbal reminder when they check in for their appointment that the firm now offers easy online payment options for their convenience.

3. Send bills promptly

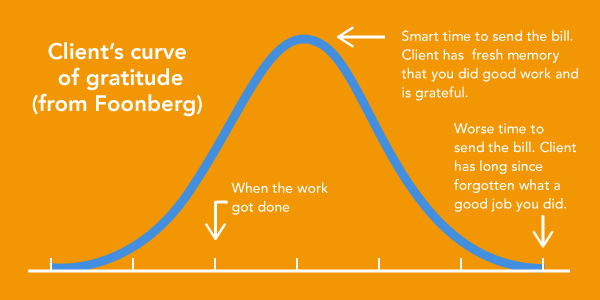

Attorney Jay Foonberg’s Client Curve of Gratification has become a household name in law schools across the country, but its tenets can apply to any professional service firm. The core concept is this: every day you delay sending the bill, a client’s memory of their CPA’s work (and their satisfaction with it) gradually diminishes—to the point where the client eventually wonders why they should pay for this service at all.

If you manage billing for your firm, bill clients as soon as their CPA has completed their work, or as close to that time as possible. As the client is wrapping up their appointment, let them know that they can expect the bill within the week (or even sooner, if using an online billing option). That way, the work is still fresh in the client’s mind when the bill arrives, and they’ll be far more likely to pay promptly. If the CPAs at your firm handle their own billing, pass this information along to them or offer to take this task off their plates so you can get bills out more quickly and help boost their cash flow.

4. Create automated reminders and follow-ups

Just like you, clients get busy, which can result in bills potentially slipping through the cracks unpaid. Depending on how many clients your firm services, staying on top of multiple outstanding payments can become a hassle. Some online payment processors let you set up automatic reminders that will gently prompt the client to send a payment as soon as possible. These features can greatly reduce the amount of delinquent payments at your firm, as well as take the stress out of your work day trying to stay on top of late-paying clients.

If you handle the billing in your office, enable automated reminders in your billing and payments software. If others manage these processes, find out whether your billing or payments system has this functionality, and urge staff to take advantage of it. If your systems don’t have automatic reminders, it could be a good time to consider shopping for a more modern software solution.

5. Use recurring payments when appropriate

If you know a client will need to be billed on a monthly basis—for repeat work, for example, or work done on retainer—consider offering them the option of setting up automated recurring payments. This way, forgetting to pay a bill never becomes an issue for the client—they can provide their credit card information once and consent for their card to be automatically charged when the next payment is due.

Meanwhile, your firm gets faster, more reliable payments and more predictable cash flow without lifting a finger. If you’re shopping for a payment processor, keep in mind that some companies charge extra for recurring payment functionality, while others include it for free.

To learn more ways you can help boost cash flow in your firm, download our e-book, “Getting Paid: What CPA’s Need to Know in 2018.”

About the author

John Lehman